Asked how he got so rich in the stock market, Baron Rothschild said, “I will tell you my secret if you wish. I always sell too soon.”

Collaring a portfolio is a defensive, hedging strategy that investors may desire to employ every 4-6 years or so after the typical bull market has allowed their portfolio of stocks to attain the high price level they had hoped for. One might desire to take some risk off the table by collaring a particular stock or stocks that have had a terrific run. A cautious investor might like to harvest those nice gains with some downside protection. A hedging strategy would accomplish this goal while avoiding a capital gains tax and maintaining the same dividend income.

Collaring is also a tax strategy. Collaring a stock protects a large gain and avoids the capital gain tax that would result if the investor sold that stock and went into cash. The federal capital gain tax can reach 20% for a wealthy investor. The Obamacare investment tax can add an additional 3.8%. After adding your state tax (states tax capital gains) your capital gain tax could easily approach 30%. Some states such as California have a double digit tax rate on capital gains in addition to the federal tax.

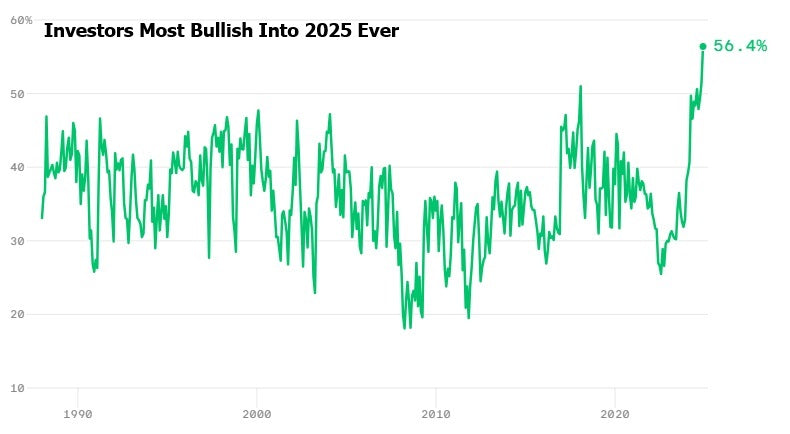

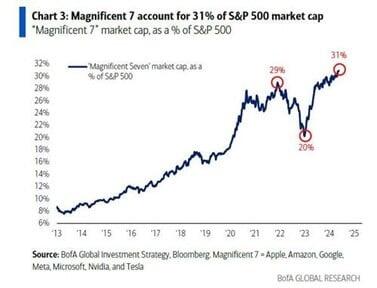

Historically, modern US bull markets last 4.5 years. This current bull market run has not been a typical one. It lasted a record 13 years until peaking December, 2021. The S&P then dropped 28% and the Nasdaq 37% into the first week of an October 2022 Covid low. To combat the government shutdown, the US government flooded the economy with free money. The Treasury goosed the Money Supply (M2) by $5 trillion (an incredible 40%) in less than two years and the Fed chipped in $500 billion to bail out three banks. The S&P has since rallied back to an all-time high (the Nasdaq hit a high in early November) over 16 years after the 2009 market bottom. Whew! Thanks to massive Federal Reserve printing and government spending the markets have been flooded with liquidity. This historic bull market celebrates its momentous 17 year birthday in March, 2025.

Perusing your portfolio, you might come across some wonderful stock winners whose profits you may want to protect after such an extraordinary market run. Especially after watching the market swoon and heroically come back thanks to the government firehose of liquidity. One does not hedge or collar a stock at $30 that was purchased at $20. But, for example, if that stock has appreciated to $90 from $20 the past 12 years one might want to lock in that $70 gain without paying a hefty capital gains tax. Collaring is not a market timing strategy but a profits timing one.

Another advantage of collaring is the ability to keep your dividend income. You would still own that stock after collaring it. Some people depend on their stock dividends to supplement their income. Selling a greatly appreciated stock conservatively harvests your gain but it puts you into cash with another decision to make. Although short term bonds now yielding near 4.5% is a fixed income alternative, the S&P now yielding 1.3% is not. Selling your appreciated stock leaves you with a difficult investment choice in this inflationary environment. With inflation “reported” at 3.2% (I think higher), bonds have to continue to sell off or inflation has to come down to close the “real” return gap. Historically once inflation grabs your pocketbook, it stays with you for many years. Prices never go back to where they were.

After paying a capital gains tax on the stock sale an investor is then left with the decision of what to buy now to replace that dividend income. Does an investor hope the stock doesn’t correct too much in this bear market or does he sell his stock to harvest the large gain and pay the capital gain tax? He instead might want to hedge his gain, not pay a capital gain tax and maintain his dividend income. He can, for example, still give himself 10% upside and protect 90% of the downside with a collar.

It is not what you make, it is what you keep.

Collaring an appreciated stock involves buying an out-of-the-money protective put option and selling an out-of-the-money call option. The sale of the call option pays for the purchase of the put option This hedge protects your downside. With most commissions eliminated by the brokerage firms the cost to collar a stock is near zero. In a sense you now have almost free portfolio insurance. What’s not to like about that? “Barron’s” magazine calls option collaring a process “too good to be true.” It is a “heads I win, tails nothing happens” strategy. This collaring process is explained in detail on another page. Collars can be also added on indexes that have exchange traded options. Mutual funds and large diversified portfolios can be collared without cost (although on a less than an exact 1-1 relationship) by using SPX or SPY index options. Index put options and put option spreads can also be purchased (like any other type of insurance) to hedge less diversified portfolios for a 3-5% cost of the portfolio value. There are many no-cost and small cost ways to hedge your portfolio. Heads you win, tails nothing happens.

If you are young and just starting to build a portfolio then dollar cost averaging is probably the best strategy for you. No need to collar. Bear markets are buying opportunities. A small portfolio doesn’t take much of a hit and you have many years to make back your losses. However, when you are older or have a large portfolio then a 50% market correction is no fun. Bear markets are to be avoided. The 2000-2003 bear market knocked the S&P for a 50% loss and the Nasdaq tumbled 82%. It took the S&P 7 years to recover and it took the Nasdaq 16 years to bounce back to its former 2000 high. The 2007-2009 bear market smacked the S&P for a 58% haircut and lopped off 12 years of stock market gains at its nadir. It took 25 years after the 1929 crash for the stock market to get back to even. . Thanks to the Federal Reserve’s massive money printing stimulus (Quantitative Easing), the stock markets have continually been rejuvenated since 2009. The Fed has officially stopped QE (visit the Blog section) but the Treasury Department has picked up the slack with accommodating deficit spending. The stock market is now more overvalued than the peak in 2000. When will we begun another (overdue) bear market? JP Morgan’s Jamie Dimon said a “hurricane is coming.” It might be prudent to lock it some profits with a few option collars on this market rally just in case.

“When did Noah build the Ark, Gladys? Before the rain, before the rain.” —Nathan Muir (Robert Redford), in Spy Game.

If you are nervous about the stock market’s elevated level, content or pleasantly surprised with your portfolio’s performance and nervous about giving back some of your great gains, perhaps a collar strategy is for you. It might be time to take some profits off the table, keep your dividend income and avoid a costly capital gains tax. It is difficult to time a bull market top. No one knows when the next bear market will commence. However, this should not be a big issue for a collar candidate. The older one is and the greater the size of one’s portfolio the more a prudent investment strategy should be adhered to. A 20% loss might be more painful and be less satisfying than a 20% gain. Especially if it takes many years to regain that loss.

If you are an RIA or portfolio manager there are considerations for you too.

“Advisors are continually focused on adjusting client portfolios for maximum return while also managing risk. But is the same true for how they manage their own ‘wellness’ portfolio?” In late 2017, FlexShares surveyed more than 700 financial advisors on their own perceived wellness. They were queried across a variety of criteria. The survey reveals that advisors are stressed – 25% more stressed than the average American.” Advisors are responsible for the safekeeping the millions of dollars of gains that their clients have accrued during this past record 15 year bull market. A collar strategy is not for everyone. It only makes sense after a bull market. Your clients would appreciate you mentioning a collar strategy if they have gains they might want to protect without having to go to cash and pay a federal and state capital gains tax. You can’t get in trouble for being too conservative. An Advisor’s quest for some of his clients might be one of preservation of capital rather than further market gains.

Estate Planning Considerations

Collaring an appreciated stock preserves its low basis. That basis gets a step-up in value upon the holder’s death. Selling an appreciated stock (not collaring) is a taxable event. In our example above, selling a $90 stock with a basis of $20 effectuates a capital gain tax on the $70 gain. Collaring that stock and keeping that stock in the holder’s portfolio until death avoids the $70 tax. The $20 basis is stepped up to $90 (for example if the holder dies when the stock is $90) or whatever the price of the stock is at death. The heirs are distributed that stock at $90, their new stepped-up basis. Why pay capital gain taxes to the IRS when you can totally avoid that tax with a stepped-up basis.

Friends Don’t Let Friends Buy and Hold.

- Recovering from a 20% loss requires a 25% gain

- Recovering from a 30% loss requires a 43% gain

- Recovering from a 40% loss requires a 67% gain

- Recovering from a 50% loss requires a 100% gain

- Recovering from a 60% loss requires a 150% gain

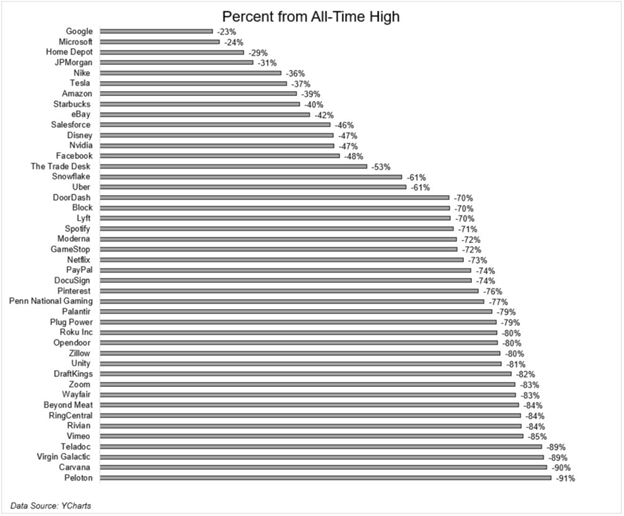

There is no safe hiding place in a bear market. There is also no such thing as diversification in a mutual fund. Bear markets do not end until every investor throws in the towel. They have never been established on optimism of a near term rally. Market bottoms are formed when everyone sells out and vows to never buy stocks again. The last two bear markets were down 50% and 58%, respectively. This current one could be worse. Look what these widely held stocks corrected in 2021 before recovering from massive Fed QE and Treasury payments. Recognize any?