What Really Is Inflation, The Hidden Tax That Affects All Of Us? There’s been a lot of talk and almost constant storylines in the media about inflation. Is inflation here to stay? Is it transitory? What will the Fed do with rates? Let’s take a step back to some more fundamental economics. For Milton Friedman, inflation was never an issue of cost-push, demand-pull or the effect of a rate increase, but a national phenomenon produced by monetary policy. Friedman concluded that inflation was always produced by high public spending and a growth in money supply. Here’s an example… when a company issues stock, it devalues the other shares outstanding. The company makes each existing share of stock worth less by the amount of new stock issued. This applies directly with the amount of currency a government puts in circulation- an increase in the amount of dollars in circulation makes each dollar worth less. Another example… news outlets report that rising labor costs add to inflation. In reality, rising wages are a symptom of inflation. A rise in costs like food prices, rent, and transportation are the result of each dollar in circulation being worth less. As a result of the pinch of lower purchasing power, workers demand higher wages in order to pay for their increased cost of living. Among the thousands of products that go up in price from the decrease in the purchasing power of the dollar, there are some supply/demand issues that temporarily influence prices. New and used car prices have recently risen from the shortage / demand in semiconductor chips. The average new car price today is $40,000. Ten years ago it was $28,000. In 2000 it was $21.800. In 1990 it was $15,500. You get the picture. Pick any product and it is much more expensive every decade from the increase in dollars in circulation.

An increase in money supply = an increase in the amount of currency in circulation = a loss of purchasing power = inflation. Simple as that. Milton Friedman coined the phrase ”inflation – the hidden tax.” Unless you constantly receive a wage increase, you can never keep up with inflation. It really is the hidden tax. Who is behind this dastardly destruction of our currency? We will discuss this and reveal the culprit (culprits) next issue.

What Recent Break-up is More Tragic and Noteworthy Than Any Romance in Hollywood?

It is the break-up of the Federal Reserve with Wall Street. Quantitative Easing (QE) officially

ended last week. No more Fed money printed out of thin air. No more money that helped propel

the S&P up over 500% and the Nasdaq over 1100% from the March 2009 bottom. No more

artificial suppression of interest rates that kept the Fed funds rate at zero for 13 years, squashed

borrowing rates for all investors and beckoned them to take more risk in the stock market. Now,

as the Fed has officially ended its QE party, Wall Street is lamenting the end of near free money

and perhaps recalling the Hall & Oates hit song.

She’s gone, she’s gone. Oh I, oh I

I better learn how to face it. She’s gone, she’s gone

Oh I, oh I. I’d pay the devil to replace her.

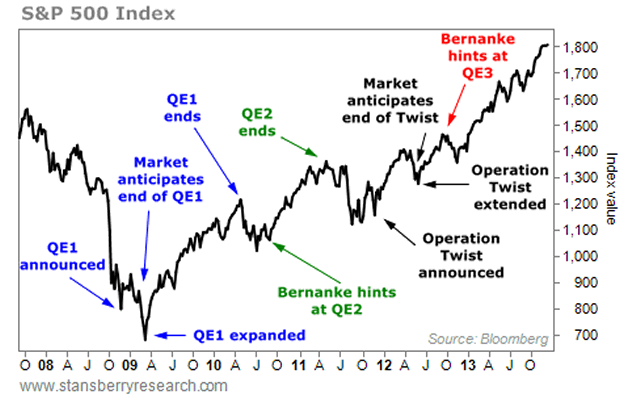

As you can see in the graph above, since 2009 every time the stock market swooned, the Fed

came in with another round of QE to bolster the market. But now that QE has ended, the stock

market is going to have to go it alone. Wall Street is single again, on the prowl for another

partner. But I don’t think it can ever find a partner as good as the Fed. Frank Sinatra’s ex-wife

never remarried. Asked why she said “Are you kidding? Who’s ever gonna’ replace Frank

Sinatra?” The stock market is now in the same bind.

The Government, through fiscal policy, can flood the economy with money, as it did with the

Covid checks and PPP loans. Maybe some of this largess will seep into the stock market. But

the Government also needs the Fed to buy the debt it issues from the Treasury to make it all

happen. The Government needs the same Fed partner as the stock market. But she’s not

available. QE is gone.

She’s gone, she’s gone. Oh I, oh I

I better learn how to face it.

She’s gone, she’s gone.

Oh why, what went wrong?

What went wrong? What went wrong is the onset of inflation. The Fed expanded its Balance

Sheet by $8 tril in order to facilitate the Treasury in expanding the US government’s debt to $30

tril. The Money Supply and Deficit both soared with all the QE money created out of thin air by

the Federal Reserve. The Fed bought trillions in US government bonds from the Treasury to

suppress interest rates allowing money to flow into the economy, which directly benefited the

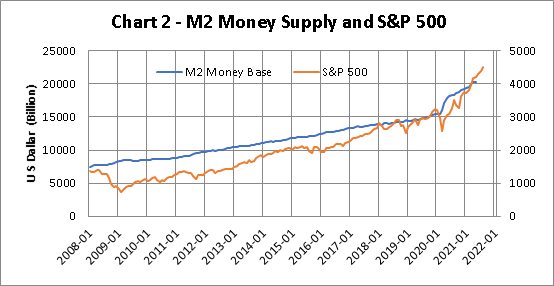

stock market. As you can see below, the increase in the Money Supply (M2) directly aided the

stock market.

But flooding the economy with money has other, less positive, consequences too. It makes each

successive printed dollar worth less. The more dollars in circulation, the less each dollar is

worth. The more dollars in circulation, the less purchasing power the average American has.

Everything costs more. With a 10% inflation rate, the dollar becomes worth 90 cents. With a

20% inflation rate, the dollar is worth 80 cents, and so on.

So the Fed made a decision. Sacrifice QE (and the stock market?) to curtail inflation. So now

after the QE break-up, Wall Street has a broken heart. It will never find a partner as good as the

Federal Reserve’s QE program.

She’s gone, she’s gone. Oh I, oh I,

I better learn how to pray,

She’s go-o-o-o-ne.

The following posts are quotes and paraphrases:

Satyajit Das: The ECB and European banks are in a “doom loop.” the ECB loans money to the European Banks at near zero interest rate to buy their country bonds to drive down rates so their respective countries can issue even more debt at lower interest rate payments. They then each guarantee each other. (Das is a renowned author and world expert on derivatives).

Fred Hickey: Wall Street is in a pickle. The stock indexes, in terms of Price/ Sales are more overvalued than ever before. It now requires perfect execution by the Federal Reserve, which has been been wrong on every single macro forecast since the 2008 financial bubble (GDP, housing, subprime, etc) to keep the markets inflated. (Hickey is only “Barron’s” Roundtable participant to have correctly called every bull and bear market cycle since 1992).

Frederick Sheehan: Business Week, October 19, 1929: “There is…reassurance that, in the fact that, should business show any further signs of fatigue, the banking system is in a good position now to administer any needed tonic from its excellent Reserve system.” (Sheehan is a highly esteemed financial author).

Eric Sprott: “All this money printing is designed to help the U.S. address its massive obligations, which include its current debts and off-balance sheet obligations of around 80 trillion dollars. Their annual revenues are only around 2.8 trillion dollars and their expenditures are 3.5 trillion. Everyone knows there’s no way they can afford to keep going and cover their obligations. This leaves money printing to cover the gap”. (Sprott is a celebrated money manager known for his timely calls in precious metals).

James Walker: When people start asking questions about the efficacy of the current monetary policy they will realize the Central Bankers are not to be trusted. If they are not to be trusted after printing trillions of dollars, there will be a movement into harder assets. This has already happened in India and China the last two years. At that point we will be lucky in the West if there is any physical gold left when the time comes. (Walker is the eminent head of the highly successful Asianomics).

Christopher Wood: “…has a provocative long-only asset allocation for U.S. pension funds: 50% physical gold bullion, 30% Asia ex-Japan equities, and 20% unhedged gold-mining stocks”. (recent “Barron’s” interview. Wood is the renowned chief strategist at CLSA- Asia and perennially voted top strategist in Asian industry polls).

Russell Napier: “Given deteriorating economic fundamentals, deflation is likely to occur in the United States. Once deflation sets in and once investors realize that QE (Quantitative Easing by the Federal Reserve) does nothing to help the real economy, the S&P 500 Index will likely collapse (at least 50% down, although probably not all in one year. (Napier, an esteemed independent strategist and co-

Quoting Alan Greenspan in “Gold and Economic Freedom” : “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.”