Ben Bernanke as a young boy:

Three “Barron’s” articles on the benefits of Zero Cost Option Collaring follow:

Barron’s Magazine “The Striking Price”

How To Hedge Your Bets in 2015 By Stephen J. Solaka Jan. 3, 2015

“No one really knows what the Fed’s higher rate policies will mean for the markets. Here are some ways to protect your portfolio.

Wall Street loves predictions and quantitative models. They give hope to investors even if they don’t affect the market’s ultimate performance. Now, like most years, the New Year begins with market strategists calling for equities to rise, albeit modestly, over the next 12 months. This is fine, but savvy investors know crystal-ball predictions offer little help on positioning for what lies ahead. Hence, there is always a collision between markets and models. The difference is volatility.

Though 2014 wasn’t a volatile year—October and December were exceptions—many veteran options traders expect 2015 to be erratic. October and December’s “volnados” should be viewed as precursors to 2015. The Street is now so accustomed to low interest rates, which have pushed most investors further out on the risk curve, that any changes will likely reverberate through the market. When this might happen is the major question of 2015.

The Federal Reserve isn’t offering many hints. It recently amended its rate-setting committee policy statement to indicate it will be “patient” about making its decision and that rates will be low for a “considerable time.” Yet the U.S. economy, including employment, is improving. Still, bond yields are low and many investors depend on equities to generate capital appreciation and income via dividends.

So the challenge for 2015 is how to remain invested in equities while accounting for the volatility that rate hikes could cause. Depending on an investor’s risk appetite, protective options strategies are worth considering to temper potential volatility.

Incredibly, it’s now possible to hedge a portfolio that tracks the Standard & Poor’s 500 index for no cost, except commissions. This can be done with a put-spread collar. The strategy builds on the classic collar that entails buying puts and selling calls with strike prices below or above the market price of a security. A put-spread collar involves selling a put, which helps lower the cost of the overall hedge. In exchange for greater upside, the portfolio will be protected only between the long and short put strike prices, which is something investors should be aware of.

Say an investor thinks 2015 will be characterized by low volatility and a modest rally in the stock market. Despite his bullishness, he’s concerned about hedging the extraordinary unrealized gains in his portfolio. With the S&P 500 Trust (ticker: SPY) at $208.60, this investor would buy the SPY December 2015 186 put and sell the December 2015 170 put for a total of $3.00. He could then sell the December 2015 230 call for $3.20 to pay for the protection. This trade, which generates a 20-cent credit, will protect a portfolio if SPY declines between 186 and 170—the put spread strike prices—and caps gains above 230.

I like put-spread collars because they help investors reduce risk without giving up too much upside. At the same time, put-spread collars tend to be attractively priced, which is critical because hedging is often an added expense that limits gains.

To hedge or not to hedge is often a personal decision. Many individual investors abhor spending money to reduce risk, which is ironic because so many professional investors spend the majority of their time trying to contain market risk.

It is true that buying-the-dip worked well in 2014. Any decline in equities was sharply reversed, and the S&P 500 index ended the year dancing around record levels. As the New Year starts, nobody really knows what 2015 will bring if, as expected, the Federal Reserve raises interest rates. This much is certain: A few well-placed puts and calls should keep cautious investors in the game should market conditions change.”

Barron’s Magazine “The Striking Price”

“A Hedge That Helps Stock Investors Stay in the Game. How a trader cuts risk by using S&P 500 options. By Steven S Sears October 4, 2014

In the immortal words of those great American philosophers, the rappers in Public Enemy, “Don’t believe the hype.”

Yeah, the market tanked Wednesday in response to weak economic data, but the bull party probably hasn’t ended, despite what some overly emotional pundits claim. More volatility may be in the future, and stocks will likely again get knocked around from their near-record levels. But can you name a place with better prospects, and deeper liquidity, than Fortress America?

We have our problems, but that is almost always true. Without getting into the weeds about a potential interest-rate hike in 2015, and other assorted hobgoblins that require economic degrees to discuss with authority, it makes sense to figure out how to live with risk, rather than being paralyzed by it.

AS WE OFTEN DO, we asked Stephen Solaka of Belmont Capital, a money-management firm, to help us structure a portfolio hedge. His last recommendation to hedge the Standard & Poor’s 500 with a put-spread collar turned out well (“A Cheap Way to Hedge,” Aug. 30).

Now, Solaka likes taking profits and readjusting his late August S&P 500 ETF Trust (ticker: SPY) hedge. He says that the hedge expresses his view that the stock market won’t rocket back to its highs, at least by late November. The hedge also protects stock portfolios that track the S&P 500 against a fall swoon.

When SPY was at 194.35, Solaka liked selling the SPY November 201 call and buying the November 189 put and selling the November 182 put. In recent trading, this could be executed for no net cost, other than the transaction fees. The first version of this trade, which also was established without cost, could have been sold for $2.80 when SPY was around 193.

Solaka says the hedge keeps investors in the game with less risk. What’s not to like about that?”

Barron’s Magazine “The Striking Price”

“A Cheap Way to Hedge. How to protect your stock portfolio from an October swoon by using an inexpensive “put spread collar.” By Steven S. Sears Aug. 30, 2014

To hedge, or not to hedge. It’s not so much a question anymore, as it is a riddle. Anyone who has hedged this year has lost money as the stock market has ground upward, shrugging off all sorts of bad juju that is normally cause for a nice big correction.

Yet talk of rising volatility, which would be accompanied by a stock decline, is starting to swirl around the Street. Investors are increasingly discussing what it means that the CBOE Volatility Index (VIX) is historically low while bearish put prices are expensive. The short answer is that investors are edgy and some are now buying defensive puts.

MUDDLING THE DISCUSSION about what happens next is a fact that all investors understand, even if they don’t understand options.

Hedging stock portfolios has been one of the worst trades over the past five years as the market rebounded from the credit-crisis lows. The better trade has been buying stocks on dips, rather than wasting money on hedges that would increase in value if stock prices fell. “This will end, but when? Only the Fed knows,” says Michael Schwartz, Oppenheimer’s chief options strategist, who can’t recall a more difficult market to hedge in his 50-year career.

Despite all the palavering about what the Federal Reserve will do, no one knows when the central bank will raise rates from their current historically low levels, or even stop buying bonds. Many people think something might happen this fall.

But this is a fact: The stock market is entering the historically volatile fall period. Major indexes are trading around record highs. Portfolio-hedging costs are historically low. Many investors have made a lot of money in the past five years since the stock market began recovering from the financial crisis.

With fall soon here, there is an expectation that implied volatility, the essence of options prices, will increase. Most of the stock market’s major corrections have occurred in October. September is the month of psychological dread, and is usually even more volatile than October because volatility increases in anticipation of history’s cyclicality.

Though it is difficult to recommend spending money on hedging, it is easier to suggest doing so with virtually no cost.

Stephen Solaka, a partner with Belmont Capital, a Los Angeles money-management firm, is advising clients interested in hedging stocks to use a “put spread collar.”

With the S&P 500 SPDR Trust (SPY) at 200.35, Solaka says, investors can buy November 195 puts and sell November 185 puts. This is a classic “put spread” that investors use when they want to cost-effectively hedge against a specified decline. In this case, the hedge provides investor protection between 195 and 185.

TO FURTHER LOWER THE COST of the hedge, Solaka likes selling an S&P 500 SPDR Trust November 205 call. The call sale “collars” the portfolio and obligates investors to cover the SPY call at a higher price or sell stock if SPY is above 205 at expiration.

The traditional collar strategy involves buying a put and selling a call. The put spread collar is better than a regular collar for a moderate hedge, as the protection can be closer to market prices as the short put helps offset cost. A traditional collar would use puts that are further out of money.

The hedge’s key risk is that the market is just below the 205 call strike. If that bothers you, let your profits ride. But if you want to lock in profits and protect against a decline, it’s hard to beat Solaka’s hedge.”

Gold and Solipsism

Solipsism (solus, latin for “alone”, ipse for “self”) is the philosophical idea that only one’s mind is sure to exist. Rene Descartes took existence personally, “I think, therefore I exist.” George Berkeley 100 years later in the mid-1700s took it a step further. He believed that objects like chairs and tables are ideas of the mind of those who perceive and only cannot exist unless they are perceived. Ben Bernanke has his own definition of solipsism. He believes fiat currency is the most genuine form of money. Gold has existed for centuries historically as the truest form of money but Central bankers believe it is a chimera. They want you to wittingly accept the dollars, yen, renminbi, swiss franc and pound currencies they freely manufacture. In the past six years, the world Central Banks have created $16 trillion out of thin air.

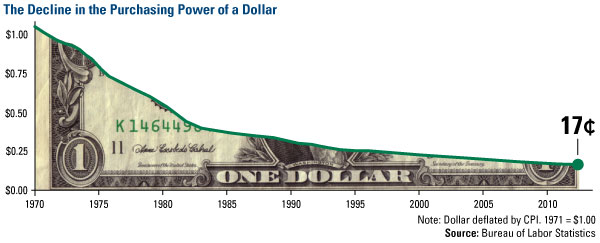

Have you ever dreamed of having a counterfeit machine in your basement to quietly take care of those pesky bills and loans? Central bankers have made that a reality. Since 1971 when the US went off the gold standard the dollar has lost over 80% of its value. Gold was $35 then. It is now $1300.

Janet Yellen and the Fed are continuing the belief that Ponce de Bernank has discovered the economic fountain of youth. Creating liquidity by printing trillions of dollars can cure all our ills. Debt upon debt obviates the need for real productivity. We can remain a prosperous nation and continue our consumption habits merely by borrowing more. The debt we incur to live beyond our means is a minor inconvenience to be addressed at a later date. Sigmund Freud added to Descartes’ and Berkeley’s theories of denial. He believed that consciousness makes us aware only of our own state of mind. We often suppress reality in order to cope. The Central Banks are suppressing the historical value of gold in order to proffer the opinion that inked government paper backed by hollow promises is more valuable.

Solipsism syndrome is a dis-associative mental state. It believes material objects only exist if the mind believes it exists. Gold is an ancient relic that only has value if you believe it has value. Okay, I will buy that. But gold has steadily increased in value over time. Antithetically, fiat currencies have only decreased in purchasing power over time. Yet, the Federal Reserve wants you to believe the US dollar, which has dramatically deteriorated over time, has greater value.

Descartes ultimately laid the foundation for Rationalism. He rejected the proclamations of alchemists. Would he reject the alchemistry of the Central Banks today? Most certainly. The age of Enlightenment followed, championed by Spinoza, and the Empiricist school of Locke, Berkeley and Hume. They believed in the ability of the mind to transcend reality but ultimately believed that historical beliefs based on facts stood the test of time. For Emanuel Kant, Enlightenment was mankind’s final coming of age. It was the “emancipation of the human consciousness from an immature state of ignorance.”

The Unenlightened Federal Reserve and world Central Banks are practicing an immature ignorance of the value of money. They want to lead us back to the Dark Ages of alchemy 300 years ago. Buy gold.

Fred Crossman